California New Car Dealers Association Releases Year-End 2023 Auto Outlook Report

Contact: Autumn Heacox, Communications & Marketing Director: aheacox@cncda.org, (916) 441-2599 x105

CA 2023 Auto Market Recap: Highest Registrations Reported Since 2020

New Vehicle Registrations Post 11.9% Increase in 2023

The California New Car Dealers Association (CNCDA) released its fourth quarter 2023 California Auto Outlook report today. The report summarizes vehicle registration and sales data for 2023, and estimates projected 2024 sales in California’s vehicle market. CNCDA’s Auto Outlook data is sourced from Experian Automotive.

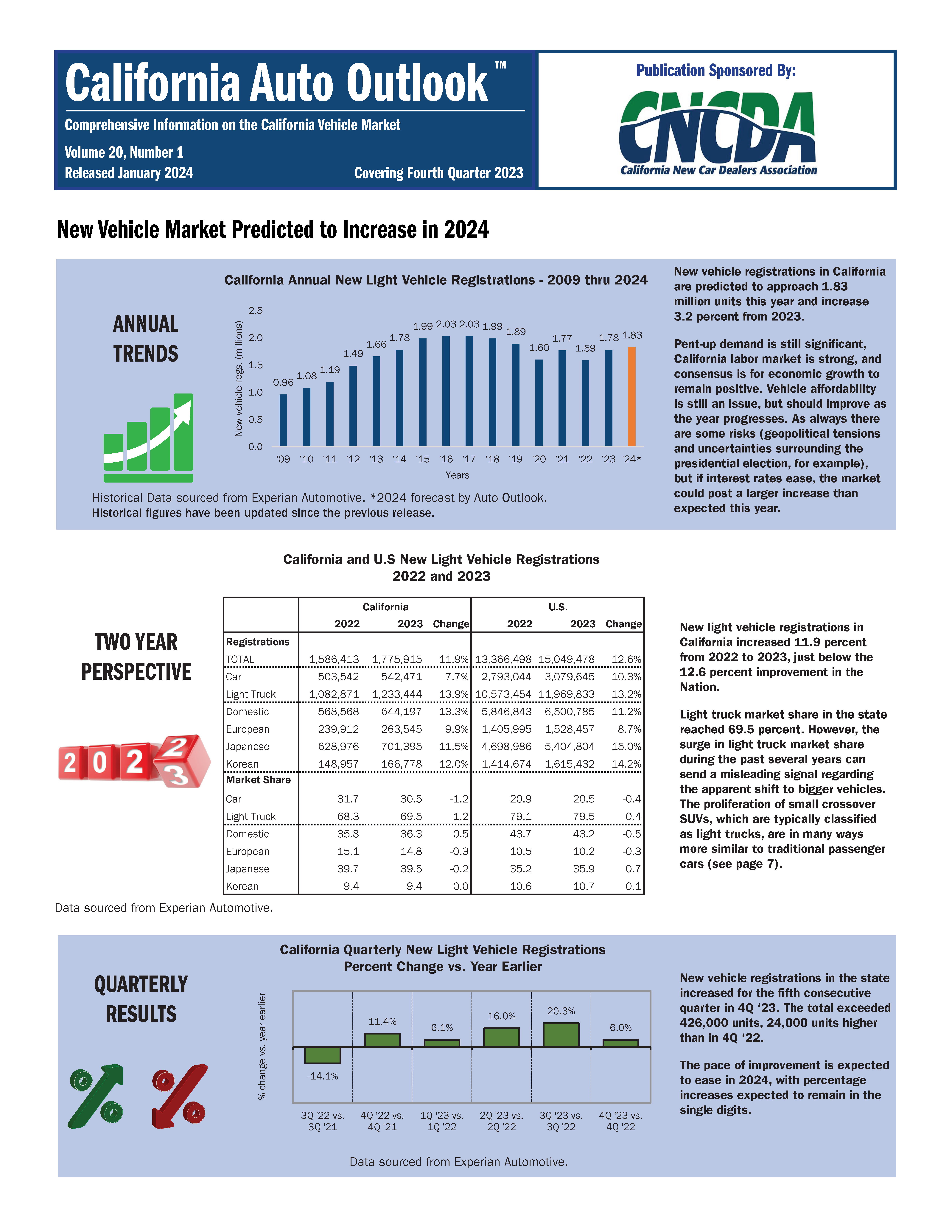

Major takeaways: 2023 proved to be a banner year for new car sales in California, reaching the highest numbers since the COVID-19 pandemic, with 1.78 million sales reported (higher than the 1.76 million predicted by this publication last year). Year over year, the state’s 2023 new vehicle registrations posted an 11.9 percent increase (1,775,915) compared to 2022 figures.

The top three passenger cars sold in California in 2023 were the Tesla Model 3, the Toyota Camry, and the Honda Civic. The top three light trucks for the year were the Tesla Model Y, the Toyota RAV4, and the Honda CR-V. Toyota held its place as the top-selling brand in California again in 2023.

Predictions for 2024 include another increase in new vehicle registrations by 3.2 percent, approaching 1.83 million units sold. This is due to the state’s significant and lasting demand for new cars, a strong labor market, and a positive economic outlook statewide. Potential threats include the 2024 presidential election, geopolitical tensions, etc. However, should Federal interest rates level out, auto sales in California are poised to post a more significant increase than predicted. These predictions are based on current trends and market conditions and may be subject to adjustment.

The report highlights the fifth consecutive quarterly increase in new car sales in the state. The Q4 2023 pace of new car sales showed a slight acceleration compared to Q3 (20.3 percent), posting a respectable 6 percent increase. The 2023 final registration numbers exceeded 426,000 units, 24,000 units higher than reported in Q4 2022.

“Overall, 2023 was a solid year for our businesses. We were able to adapt and evolve to meet our customers’ needs and preferences while remaining community stalwarts,” says David Simpson, CNCDA Chairman and owner of Simpson Buick GMC Cadillac of Buena Park, Simpson Chevrolet of Garden Grove, and Simpson Chevrolet of Irvine. “We do our best to work with our respective manufacturers to inform them about statewide customer trends and order the vehicles that Californians tell us they want when they walk onto our lots daily.”

Vehicle Powertrain Dashboard

The report’s new vehicle powertrain dashboard details the state’s battery electric vehicles (BEV), non-plug-in hybrid, and plug-in hybrid (PHEV) sales and market health. The state’s BEV market share declined in Q4 2023 from the previous quarter, closing the year at 21.4 percent. Alternatively, the state’s non-plug-in hybrid vehicles jumped to their highest numbers, at 11.1 percent sold in 2023. California’s total new BEV market share sales increased by five percent compared to 2022.

ICE-powered vehicles (gas and diesel) accounted for 63.9 percent of the state’s new vehicle sales share in 2023, losing about 7.7 points from 2022 numbers. In 2023, combined sales of BEVs, PHEVs, hybrids, and fuel cell vehicles in the state accounted for 35.9 percent of the market share (compared to 11.6 percent in 2018).

California leads the way in BEV registrations, posting 33.8 percent of all sales nationwide. The U.S. market share of BEV vehicles is less substantial, posting 7.5 percent in 2023.

Hybrids and Electric Vehicles

California’s top three selling BEV and PHEV models are the Tesla Model Y, Tesla Model 3, and the Chevy Bolt. The Jeep Wrangler captured fourth place and remained the best-selling PHEV in 2023.

While Tesla remains California’s BEV market share leader, its lead is diminishing as traditional automakers roll out new electric models. Tesla showed a significant decline in sales in 2023, with a 10.5 percent loss in market share YTD. Mercedes and BMW showed the highest increase in BEV sales in the state, reporting 2.2 and 2.8 percent, respectively.

In 2023, franchised dealerships accounted for over 62 percent of all alternative powertrain types in combined sales. Last year, franchised dealership sales in the BEV-only market increased to 35.8 percent. Sales of BEVs at franchised dealerships rose 94 percent from 2022 to 2023, compared to a 29 percent increase by direct sellers. This helps further demonstrate that Californians are interested in purchasing new BEV model rollouts from the mainstay manufacturers that they know and trust.

In 2023, Northern Californians remained the significant adopters of BEVs, capturing 25.6 percent of the state’s BEV market share, while Southern CA sales reported 21.3 percent of registrations.

Model Segment Rankings

California’s 2023 best sellers in the primary segments include the Honda Civic, Toyota Camry, Tesla Model 3, Toyota Tacoma, Ford F-Series, Toyota RAV4, Subaru Outback, and the Lexus RX.

Brand Market Share and Summary

Brand registrations increased in 2023 for 26 of the top 30 selling brands in the state, with Toyota remaining California’s market share leader, holding 15.7 percent. Tesla follows at 13 percent, Honda holds 9.7 percent, Ford at 7.7 percent, and Chevrolet at 6.7 percent.

The state’s registration numbers do not mirror the rest of the U.S., which reports Toyota (12.6 percent of share), Ford (11.8 percent), and Chevy (at 11.2 percent) as the top-selling brands in 2023.

The brands showing the most significant positive change in 2023 registration numbers in California were Rivian (142.7 percent), Buick (57.3 percent), Infinity (34.7 percent), Honda (33.4 percent), and Audi (31.5 percent).

Regional Variances

Car and light truck retail registrations from Northern and Southern California markets are up from last year. The Northern market captured an additional 10.1 percent of the statewide total year over year, with the Southern portion of the state showing an 8.8 percent increase from 2022.

###

California Auto Outlook Quarterly is produced for CNCDA by Auto Outlook, Inc., an independent research company that analyzes statewide and regional automotive markets. When reporting these auto industry trends, please acknowledge the Data Source: Experian Automotive.

The report provides comprehensive information on CA’s new vehicle market, includes annual trends, a two-year perspective, vehicle powertrain dashboard, segment watch, the top models in each segment, brand scoreboards, regional comparisons, and more. Access the complete report at www.cncda.org.

About CNCDA

For 100 years, the California New Car Dealers Association has represented California’s franchised new car and truck dealers. CNCDA members are primarily engaged in the retail sale and lease of new and used motor vehicles and provide automotive products, parts, services, and repairs. In 2022, California’s franchised new car dealers sold more than 1.6 million new cars and trucks, employed more than 136,000 people, paid $8.46 billion in sales tax, and donated $62.84 million to charitable and civic organizations. As the nation’s largest state association of franchised automotive dealers—with over 1,200 members—CNCDA provides legal compliance and legislative, regulatory, and legal advocacy.