California New Car Dealers Association Releases Q2 2024 Auto Outlook Report

Media Contact: Autumn Heacox, Communications & Marketing Director: aheacox@cncda.org, (916) 441-2599 x105

Q2 2024 CA Auto Outlook Report: Has Tesla Peaked in CA? Sales Slip 17% YTD;

New Vehicle Registrations Decline Slightly; Ioniq 5 Steals Third Place in EVs

SACRAMENTO, CA, July 18, 2024— Today, the California New Car Dealers Association (CNCDA) released its California Auto Outlook covering the first half of 2024. The report summarizes California’s new vehicle registrations and predicts anticipated yearly sales. For accurate reporting, please cite Experian Automotive as the data source for CNCDA’s Auto Outlook.

Key Highlights

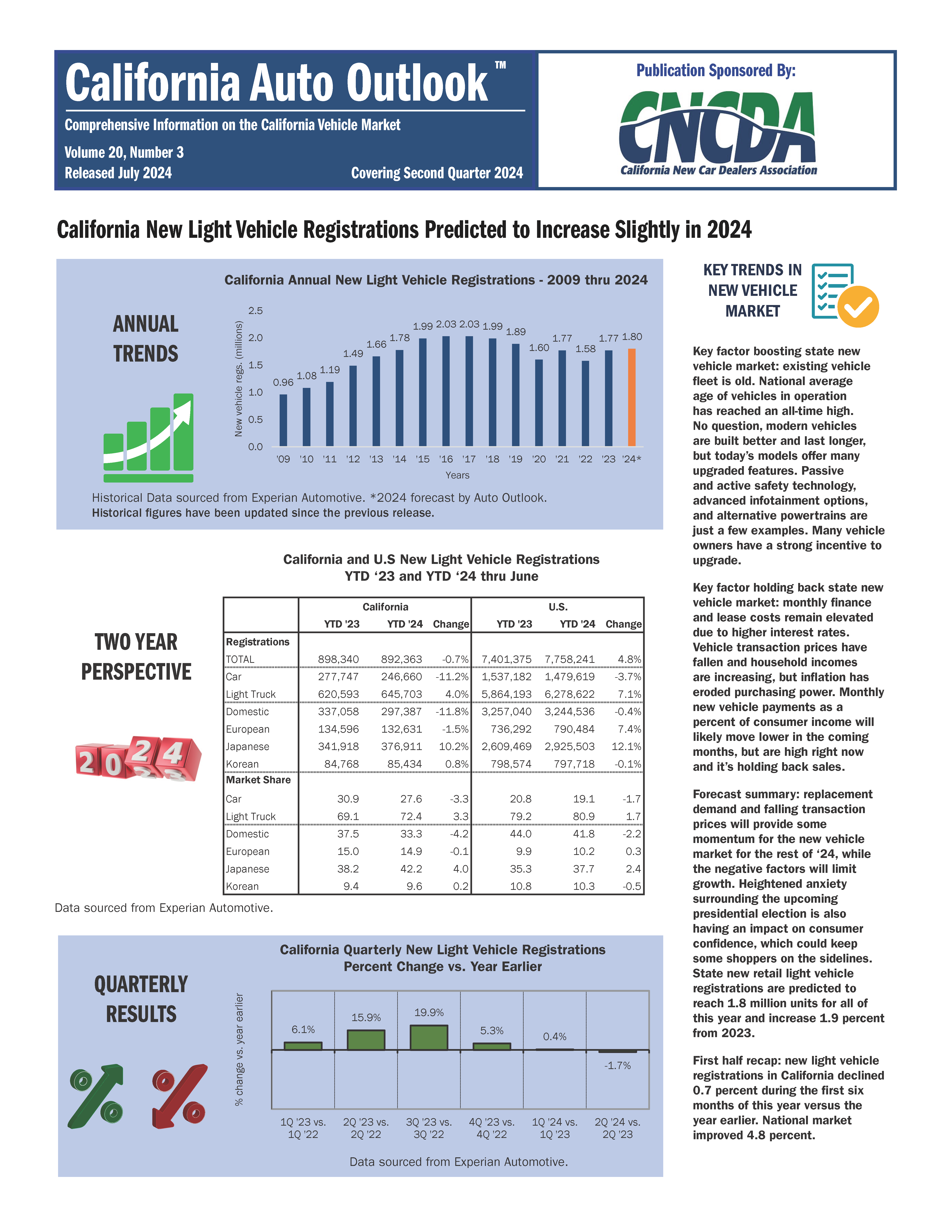

California’s new light vehicle registrations fell by .7 percent YTD compared to last year, totaling 892,363. Despite this decline, the State is on track to hit a forecasted 1.8 million new vehicle registrations by year-end. Higher interest rates and inflation are squeezing consumer budgets. Still, the aging vehicle fleet (at a record all-time high) and technology and safety upgrades in new models are keeping the market resilient.

Tesla’s future appears to be dwindling as the brand’s sales continue to decline in the Golden State; registrations are down a significant 17 percent YTD (as compared to last year). While Tesla’s Model Y remains the top-selling car in the State, Tesla sales may have peaked. This new data marks the brand’s third consecutive quarter with registration declines (dipping 24.1 percent in Q2 2024, 7.8 percent in Q1 2024, and 9.8 percent in Q4 2023).

In stark contrast, mainstay brands like Toyota, Hyundai, and Ford are on the upswing, with significant gains and excitement around new EV models that Californians seem eager to adopt. This year, Toyota’s BEV registrations rose 108.1 percent, and Hyundai’s BEV registrations rose 65.7 percent. Notably, the Hyundai Ioniq 5 stole third place (from Tesla’s Model X) of the top-selling EVs in California YTD, with 7,191 registrations.

Ford BEV sales rose by 26.4 percent, and the Mustang Mach-E became the fifth most-sold EV YTD. This surge underscores how the State’s franchised new car dealers are expertly navigating the evolving market, driving consumer enthusiasm with trusted, high-performing brands.

“It’s an exciting time to be a franchised car dealer in California. With new competitive EV models and the latest ICE options, we’re able to meet diverse customers’ needs and provide the support they want from their local dealership,” says David Simpson, CNCDA Chairman and owner of Simpson Buick GMC Cadillac of Buena Park, Simpson Chevrolet of Garden Grove, and Simpson Chevrolet of Irvine. “Our dealers are trusted community partners, providing Californians with high-quality, reliable vehicles- whether electric, traditional, or anything in between.”

Regardless of the powertrain, Toyota remains California’s top brand. With 150,964 registrations and 16.9 percent of the market share (a 2.1 point increase YTD from 2023), Toyota continues to lead the market.

Vehicle Powertrain Dashboard

The report’s vehicle powertrain dashboard details the State’s BEV, hybrid, and PHEV sales and market health. California leads the nation in BEV registrations, with BEVs accounting for 21.4 percent of sales year-to-date. Thirty-three percent of nationwide BEV sales took place in California. The U.S. BEV market share is far less substantial, posting 7.5 percent YTD.

Additionally, after six months of declines, California’s BEV market share rose to 21.9 percent from 20.9 percent last quarter. The State’s hybrid registrations showed promise, jumping to 13.2 percent, and the PHEV market share remained steady at 3.4 percent this year.

In the first half of 2024, combined sales of BEVs, PHEVs, hybrids, and fuel cell vehicles in the Golden State accounted for 38 percent of the market share. Internal Combustion Engine (ICE) vehicles (gas and diesel) accounted for 62 percent of registrations.

California’s franchised new car and truck dealers account for over 67 percent of combined sales for all alternative powertrain types this year, demonstrating consumer confidence in local dealerships and mainstay brands. This trend is evident in the sales of BEVs by franchised dealerships, which have surged by 27 percent (while direct sellers, such as Tesla and Rivian, saw a 12.3 percent drop).

Model Segment Rankings

Unchanged from last quarter, California’s best sellers in the primary segments in Q2 2024 include the Honda Civic, Toyota Camry, Tesla Model 3, Toyota Tacoma, Chevrolet Silverado, Toyota RAV4, Subaru Outback, and Lexus RX.

Brand Market Share and Summary

Tesla, the second best-selling brand in California with 102,106 registrations YTD, is facing mounting challenges. Its market share dipped 2.3 points from last year, and Q2 2024 registrations plummeted 24.1 percent compared to Q2 2023. Tesla’s allure seems to be wearing off, signaling potential trouble for the direct-to-consumer manufacturer.

Honda also reported an impressive 12.9 percent jump YTD (reaching 94,939 registrations).

As reported last quarter, the top three passenger cars sold were the Toyota Camry, the Honda Civic, and the Tesla Model 3. The top three light trucks were the Tesla Model Y, the Toyota RAV4, and the Honda CR-V.

Five brands in the State have improved registrations by more than 10 percent this year. These brands include Rivian (76.7 percent), Dodge (43.1 percent), Lexus (25.6 percent), Lincoln (23.3 percent), and Buick (19.5 percent).

Regional Variances

Northern California’s BEV market share was 24.9 percent in the first half of this year, while Southern California’s share was 22.1 percent.

Specifically, light vehicle (non-fleet) registrations in N. and S. California showed declines of 3.3 and .1 percents, respectively. Regionally, the Bay Area posted a 3.2 percent decline, LA and Orange Counties increased slightly by .1 percent, and San Diego County’s sales increased by 1.6 percent, YTD.

Click Here to Access the Q2 2024 Auto Outlook Report.

###

California Auto Outlook Quarterly is produced for CNCDA by Auto Outlook, Inc., an independent research company that analyzes statewide and regional automotive markets. When reporting these auto industry trends, please acknowledge the data source: Experian Automotive.

The report provides comprehensive information on California’s new vehicle market, including annual trends, a vehicle powertrain dashboard, a segment watch, the top five models in each segment, brand scoreboards, regional comparisons, and more. Visit www.cncda.org.

About CNCDA

For 100 years, the California New Car Dealers Association has represented California’s franchised new car and truck dealers. CNCDA members are primarily engaged in the retail sale and lease of new and used motor vehicles and provide automotive products, parts, services, and repairs. In 2023, California’s franchised new car dealers sold more than 1.77 million new cars and trucks, employed more than 138,807 people, paid $8.74 billion in sales tax, and donated $67.66 million to charitable and civic organizations. CNCDA is the Nation’s largest state association of franchised automotive dealers—with nearly 1,200 members— and provides legal compliance and legislative, regulatory, and legal advocacy.