California New Car Dealers Association Releases Q1 2024 Auto Outlook Report

Media Contact: Autumn Heacox, Communications & Marketing Director: aheacox@cncda.org, (916) 441-2599 x105

Q1 2024 CA Auto Outlook Report: Tesla Registrations Drop; Sales Slip 7.8% YTD

Overall New Vehicle Registrations Up; Toyota Market Share Exceeds 16%

SACRAMENTO, CA, April 29, 2024— The California New Car Dealers Association (CNCDA) released its California Auto Outlook covering the first quarter of 2024 today. The report summarizes quarterly new vehicle registration figures statewide and predicts overall 2024 sales. Experian Automotive provides data for CNCDA’s Auto Outlook.

Californians’ love affair with electric vehicle giant Tesla may have peaked. Tesla registrations are down again in The Golden State YTD, reporting a 7.8 percent dip (last quarter posted a 9.8 percent decline) amongst all brand registrations. Toyota showed significant gains among the top three California shareholder brands, increasing to 16.6 percent, as did Honda, capturing 10.5 percent of the market, while Tesla’s numbers faltered (11.6 percent).

As Tesla’s dominance wanes, traditional manufacturers are stepping up to the plate, offering new plug-in hybrid (PHEV), hybrid, and battery electric vehicle (BEV) models. This shift is evident in the sales of BEVs by traditional franchised dealerships, which have surged by 14 percent (while direct sellers saw a three-point drop) compared to last year’s figures. Notably, franchised dealers account for over 66 percent of combined sales for all alternative powertrain types, demonstrating consumer confidence in local dealerships and mainstay brands (despite changing market dynamics).

“We’ve spent decades, even lifetimes, building trust with our neighbors, providing great jobs, and supporting our communities. Californians are smart. They recognize that we do our best to give customers high-quality cars they want at affordable price points,” says David Simpson, CNCDA Chairman and owner of Simpson Buick GMC Cadillac of Buena Park, Simpson Chevrolet of Garden Grove, and Simpson Chevrolet of Irvine. “This is why we believe the Tesla sales model is ineffective, layoffs are happening, and people are generally dissatisfied with their level of service. We take pride in our dealerships, and it shows.”

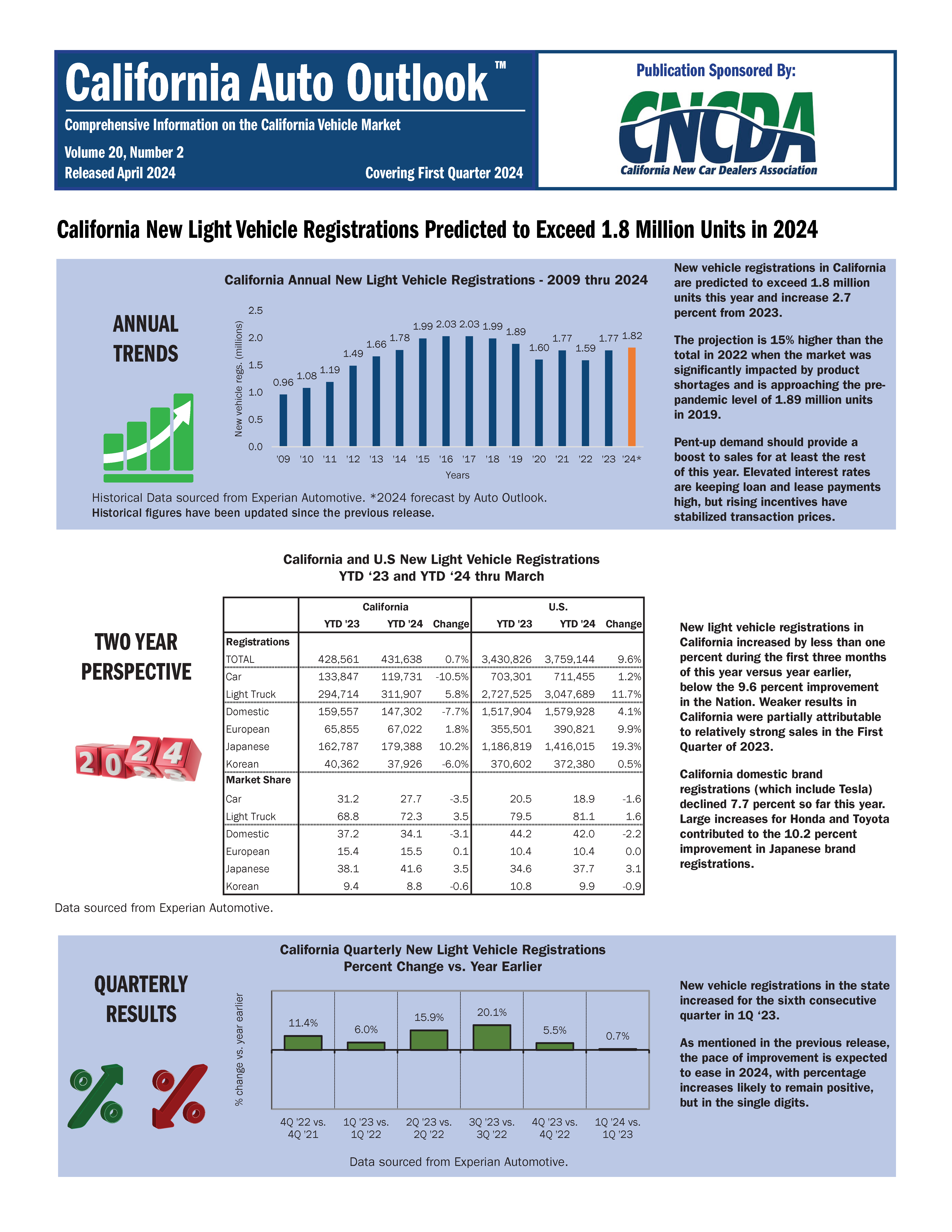

The first quarter of 2024 reports a slight increase in overall registrations at .7 percent (the sixth consecutive quarterly increase) in the State, posting 431,638 new sales. This figure is in contrast with the Nation’s 9.6 percent improvement. Weaker results in California are partially attributed to relatively strong sales in the first quarter of 2023.

California’s pace of improvement is expected to ease overall in 2024 compared to last year. While registrations are predicted to exceed 1.8M units, the increase will likely remain in the single digits.

Toyota once again secured its lead as the top brand in California, with a 9.3 percent increase in registrations, as did Honda, with an impressive 18.6 percent jump YTD. The top three passenger cars sold were the Toyota Camry, the Honda Civic, and dropping from first place to third, the Tesla Model 3. The top three light trucks were the Tesla Model Y, the Toyota RAV4, and the Honda CR-V.

Another brand of note this year is Dodge. Due to the recent introduction of the Hornet PHEV SUV, Dodge reported the second-highest positive change in California, with a 76.2 percent increase in new registrations last quarter.

Vehicle Powertrain Dashboard

The report’s vehicle powertrain dashboard details the State’s BEV, hybrid, and PHEV sales and market health. The State’s BEV market share declined for the second quarter, falling to 20.9 percent from 21.5 percent at the end of 2023. Alternatively, the State’s hybrid registrations jumped again this quarter to 13 percent (up from 11.1 percent). California’s PHEV market share slightly increased, wrapping the first quarter at 3.6 percent.

Combined sales of BEVs, PHEVs, hybrids, and fuel cell vehicles in The Golden State accounted for 37.5 percent of the market share last quarter (up from just 11.6 percent in 2018). Internal Combustion Engine (ICE) vehicles (gas and diesel) accounted for 62.5 percent of registrations, dipping about 1.4 points from the end of 2023.

California continues to lead in BEV registrations, posting 32.5 percent of sales nationwide. The U.S. market share of BEV vehicles is far less substantial, posting 7.4 percent in Q1 2024.

Hybrid and Electric Vehicles

Tesla may have the top three-selling electric vehicles in the State, however, first-quarter sales show a significant 6.4 percent YTD BEV market share loss. Mercedes and BMW showed the highest increases in BEV sales in the State last quarter, posting 3 and 2.4 percents, respectively.

Northern Californians continue to be the most significant adopters of BEVs, capturing 24.8 percent of the market share. Southern California BEV sales remained fairly level at 21.5 percent of sales last quarter.

Model Segment Rankings

California’s best sellers in the primary segments in Q1 2024 include the Honda Civic, Toyota Camry, Tesla Model 3, Toyota Tacoma, Chevrolet Silverado, Toyota RAV4, Subaru Outback, and Lexus RX.

Brand Market Share and Summary

Registrations for five brands in the state have improved by more than 22 percent so far this year. Brands showing the most significant positive percent increases were Rivian (87.1 percent), Dodge (76.2 percent), Lexus (37.3 percent), Lincoln (25.8 percent), and Volvo (22 percent).

The Golden State’s brand registration numbers do not mirror those of the rest of the U.S., which reports Toyota at 13.4 percent of the market share, Ford at 12.4 percent, and Chevy at 10.4 percent last quarter.

Regional Variances

Specifically, Car retail registrations in N. and S. California showed declines of 11.8 and 6 percents, respectively. Light truck retail registrations were up by 2.9 percent in N. California and 5.3 percent in S. California. A shining star, San Diego County’s share increased by 4.6 percent with 35,561 registrations this year.

Click Here to Access the Q1 2024 Auto Outlook Report.

###

California Auto Outlook Quarterly is produced for CNCDA by Auto Outlook, Inc., an independent research company that analyzes statewide and regional automotive markets. When reporting these auto industry trends, please acknowledge the Data Source: Experian Automotive.

The report provides comprehensive information on California’s new vehicle market, including annual trends, a two-year perspective, vehicle powertrain dashboard, segment watch, the top five models in each segment, brand scoreboards, regional comparisons, and more. Visit www.cncda.org.

About CNCDA

For 100 years, the California New Car Dealers Association has represented California’s franchised new car and truck dealers. CNCDA members are primarily engaged in the retail sale and lease of new and used motor vehicles and provide automotive products, parts, services, and repairs. In 2023, California’s franchised new car dealers sold more than 1.77 million new cars and trucks, employed more than 138,807 people, paid $8.74 billion in sales tax, and donated $67.66 million to charitable and civic organizations. CNCDA is the Nation’s largest state association of franchised automotive dealers—with nearly 1,200 members— and provides legal compliance and legislative, regulatory, and legal advocacy.