California New Car Dealers Association Releases Fourth Quarter 2022 Auto Outlook

Contact: Autumn Heacox, Communications & Marketing Director: aheacox@cncda.org, (916) 441-2599 x105

CA 2022 Year-End Auto Market Recap: Supply Chain Issues, EV Sales Spike, and More…

2023 Outlook Predicts New Vehicle Registrations to Increase

SACRAMENTO, CA, February 7, 2023 – The California New Car Dealers Association released its fourth quarter 2022 California Auto Outlook report today. The report outlines 2022 vehicle registration data and estimates projected 2023 sales in California’s auto market.

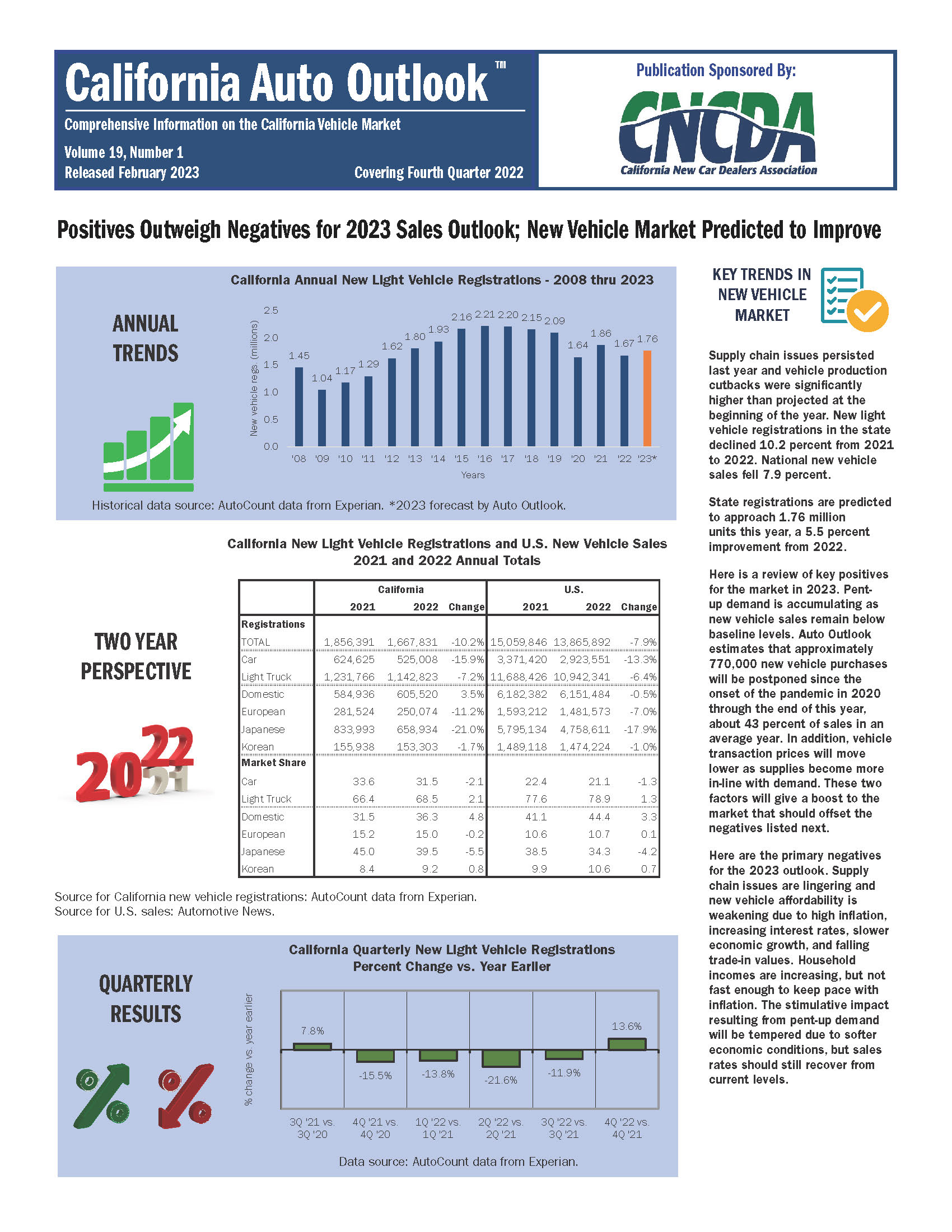

The major takeaways: Supply chain issues persisted throughout the year resulting in vehicle production cutbacks in numbers higher than anticipated. While vehicle registrations were lower than in 2021, they didn’t drop to 2020 pandemic-year levels. The fourth quarter was a bright spot in 2022, seeing a 13.6 percent increase in new light vehicle registrations versus the same period in 2021.

Predictions for 2023 include increased new vehicle registrations to 5.5 percent, approaching 1.76 million. Additionally, due to pent-up demand and low vehicle inventory availability since the pandemic, an estimated 43 percent of sales have been delayed. This along with transaction prices lowering to match supply levels should result in increased registrations for 2023. However, inflation, lingering supply chain issues, and increasing interest rates are expected to tamper these numbers.

A positive in California’s 2022 new vehicle market: sales of electric vehicles, with an estimated increase in market share of 17.1 percent. While vehicle pricing was a major concern in 2022, sales of pure EVs increased by over 50 percent from 2021. California is clearly doing its part to increase EV sales.

Notably, the hybrid market share also continues to steadily grow, despite overall declining sales.

Finally, while Tesla had the top two selling vehicles last year, Toyota retained its crown as the market share leader for vehicle brands in the Golden State.

Year-to-date, new vehicle sales in California dipped further than nationwide numbers, at 10.2 percent. Comparatively, nationwide sales dropped 7.9 percent in 2022.

Year over year, luxury & sports cars and the luxury car market shares increased by 3 percent, taking these points from the small car market in California. Overall, for 2022, the California hybrid/ EV market share held at 31.1 percent.

“With ZEV product announcements every day, we’re seeing the latest and greatest in technology and innovation in new car makes and models by the major automakers. As dealers, we are eagerly waiting to receive these cars and get them into the hands of our longstanding customers. California drivers want these cars now,” said California New Car Dealers Association Chairman, Tony Toohey, Owner of Auburn Toyota.

“Dealers know the hybrid/ EV demand in California is increasing and we are ready to help our manufacturers roll out these vehicles to meet the consumers’ needs,” said Toohey.

Brand Market Share

Toyota remained at the top of California’s market share in 2022 at 17.3 percent, followed by Tesla at 11.2 percent, Ford at 8.4 percent, Honda at 7.9 percent, and Chevrolet at 6.8 percent.

Interestingly, Californian’s appetite for Tesla vehicles is much larger than the nationwide average, which accounts for only 3.5 percent of the brand market share. Tesla, Genesis, Cadillac, Mercedes, and Kia saw increased new vehicle registrations in California year over year, while all other brands saw declines.

Fleet and Retail Market Share

The California fleet market in 2022 fared better than the retail market, with fleet car sales down only 15.1 percent (compared with retail sales down 16.1 percent). While retail light truck sales were down 9.1 percent, fleet light trucks gained 9.3 percentage points.

Primary Segment Leaders and Model Rankings

Leading luxury car and light truck brands in the Golden State included Tesla, Mercedes, and BMW. Non-luxury car brand leaders were Toyota, Honda, and Nissan in 2022. The leading non-luxury light truck brands were Toyota, Ford, and Chevrolet.

The Tesla Model Y was the top-selling light truck in 2022, with 87,257 registrations (7.6 percent of the market share). Second place: the Toyota RAV4, with 59,794 units sold. The Ford F-Series placed third and was the top-selling full-size pickup truck at 40,232 registrations. The top-selling compact/mid-size pickup truck in California was the Toyota Tacoma, holding 46.2 percent of the share.

The top-selling passenger car model in the state is the Tesla Model 3 with 78,934 registrations, the Toyota Camry came in second with 55,967 registrations (capturing 10.2 percent), followed by the Toyota Corolla at 39,865 registrations.

Regional Variances

The Southern California car market fell 17.1 percent as compared to Northern California dipping 13.9 percent. As with previous quarters, the San Francisco Bay regional market was the most insulated from a decline in sales, falling only 7.2 percent in 2022.

###

California Auto Outlook Quarterly is produced for CNCDA by Auto Outlook, Inc., an independent research company specializing in the analysis of statewide and regional automotive markets. When reporting these auto industry trends please acknowledge the Data Source: Experian.

The report provides comprehensive information on the state’s new vehicle market. The report includes annual trends, a two-year perspective, segment watch, the top five models in each segment, brand scoreboards, regional comparisons, and more. The complete report can be accessed on CNCDA’s website at: www.cncda.org

About CNCDA

For 99 years, the California New Car Dealers Association has represented the interests of California’s franchised new car dealers. CNCDA members are primarily engaged in the retail sale and lease of new and used motor vehicles, but also provide customers with automotive products, parts, services, and repairs. Our members sold more than 2 million new cars and trucks in 2019 and employed more than 140,000 Californians, significantly contributing to our state’s economy. As the nation’s largest state association of franchised new car and truck dealers—with more than 1,200 members—CNCDA provides legal compliance and legislative, regulatory, and legal advocacy.