California New Car Dealers Association Releases Second Quarter 2023 Auto Outlook

Contact: Autumn Heacox, Communications & Marketing Director: aheacox@cncda.org, (916) 441-2599 x105

CA 2Q 2023 Auto Market Recap: Registrations Surge Higher Than Expected

Sold Vehicles Up 16.8% From Last Year

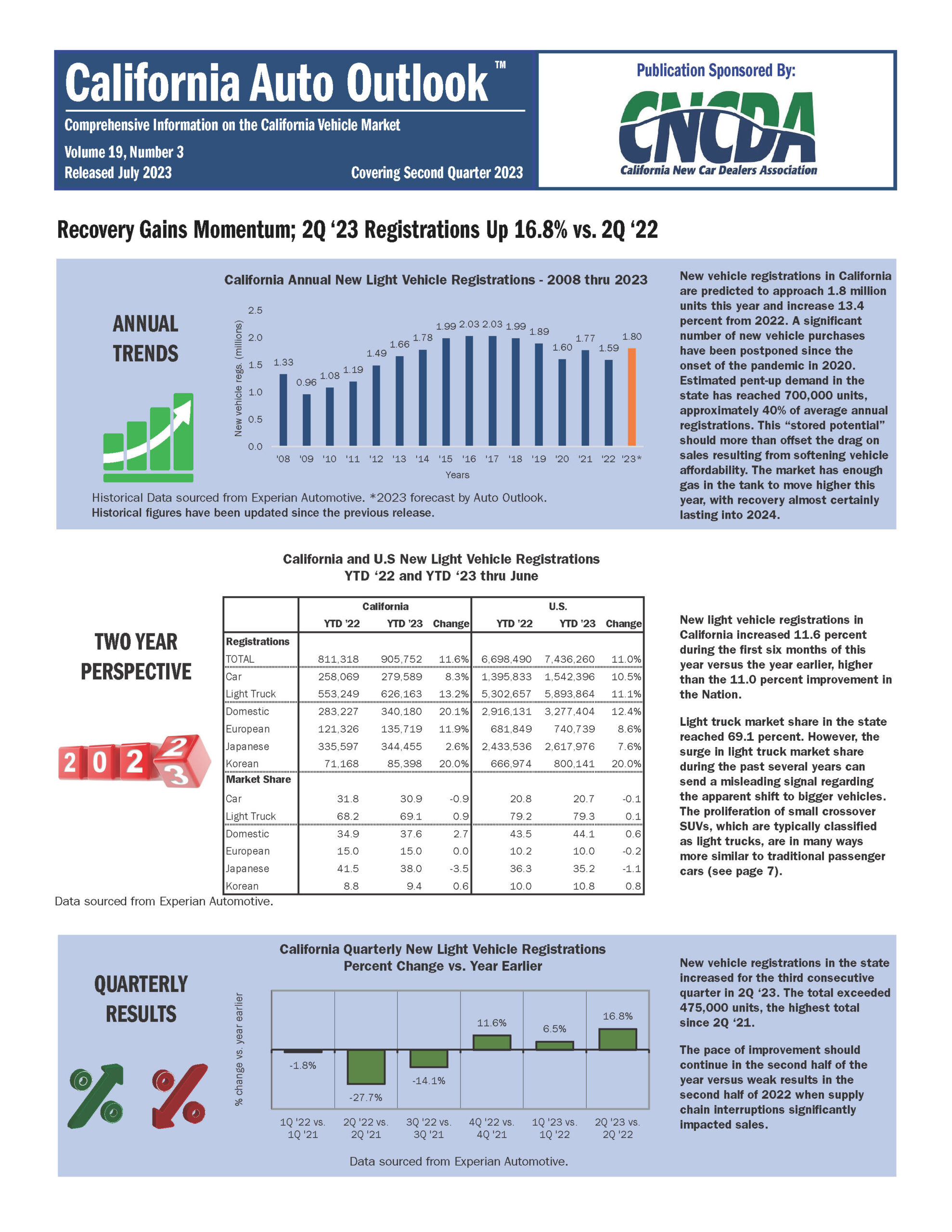

SACRAMENTO, CA, July 19, 2023 – The California New Car Dealers Association (CNCDA) releases its second quarter 2023 California Auto Outlook report today, showing an 11.6 percent increase in new vehicle registrations in the first six months of 2023 when compared to the same time last year. 2023 projections indicate registrations will reach 1.8 million units, as forecasted by Auto Outlook. This is an increase from the predicted 1.78 million from 1Q 2022, thus surpassing 2020-2022 reported figures (approaching 2019 numbers). CNCDA’s quarterly Auto Outlook Report data is provided and verified by Experian Automotive.

Continued pent-up demand is estimated at 700,000 units, approximately 40% of annual registrations. This “stored potential” is expected to offset any sales drag from softening vehicle affordability. This recovery in CA’s vehicle market has enough momentum to track even higher, with new vehicle sales predicted to grow almost certainly into 2024.

2Q 2023 is particularly noteworthy because it’s the third consecutive quarterly increase in registrations within the state since 2Q 2021, and it’s a significant bump: up 16.8 percent from 2Q 2022. For reference, last quarter’s numbers posted a 6.5 percent increase. When comparing YTD registration numbers from 2022 to 2023, registrations report at 905,752 vs 811,318 (11.6 percent increase).

“It’s a great time to purchase a new vehicle,” says Tony Toohey, CNCDA Chairman and Owner of Auburn Toyota. “We currently have rising inventories on the horizon, and we are happy to provide information to our customers about newly released traditional and electric vehicle models from our manufacturing partners,” says Toohey.

Hybrids and Electric Vehicles

The state’s BEV (battery electric vehicle) market share has exceeded 21 percent in the first half of 2023, well above the 16.4 percent reported for all of 2022. Hybrid units sold (including and excluding plug in) have tracked similar increases of .6 percent YTD each.

New registrations for BEVs sold at franchised dealerships experienced a significant growth of 125 percent in the first half of this year. As a result, franchised dealerships’ market share in the state’s new retail BEV market rose from 23.2 percent in the first half of 2022 to 32.8 percent so far this year. Registrations for BEVs sold by direct sellers saw a 40 percent increase from this time last year.

2Q 2023 showed that Northern Californians are more willing to adopt BEVs, as those vehicles captured 25.9 percent of the market share, while Southern CA BEV sales reported 20.9% of registrations.

Market Share Trends by Segment

The luxury SUV market share grew by three percent in 2023, hitting 20% of total units sold in the state YTD. The segment captured a one percent share from the non-luxury SUVs, pickups and vans, and the non-lux midsize and large car segments, respectively.

Model Segment Rankings

Toyota remained a brand leader, providing four of the eight best-selling vehicles in the primary segments for 2Q 2023. Toyota’s Camry, Tacoma, RAV4, and Highlander topped the Mid-Size and Large Cars, Comp./Mid Size Pickup, Compact SUV, and 3 Row Mid-Size SUV spots. The Honda Civic was the best-selling Small Car, the Tesla Model 3 topped the Near Luxury Car, the Ford F-Series was the best-selling Full Size Pickup, and the Tesla Model Y was the top Luxury Compact SUV.

Brand Market Share and Summary

Toyota also held the top of California’s market share at 14.7 percent amongst all vehicle brands, followed by Tesla at 13.6 percent, Honda at 9.3 percent, Ford at 8.1 percent, and Chevrolet at 6.9 percent. As the Golden State continues to pave its own way, CA’s numbers differ notably from the rest of the U.S., which reports Ford as the top-selling brand at 12.2 percent, followed closely by Toyota at 12 percent, then by Chevrolet at 11.1 percent.

New this quarter, Experian Automotive has provided detailed sales data for a previously named “Other” category in registrations by brand, which included smaller startup brands. YTD, the following brands saw more than a 22 percent increase in units sold: Rivian, Polestar, Genesis, Tesla, Chevrolet, Cadillac, Audi, and Hyundai.

Regional Variances

All registrations from cars and light trucks between Northern and Southern CA markets were up. The SF Bay Area regional market captured 14.1 percent of the statewide total, followed by LA and Orange Counties at 8.9 percent, then by San Diego County at 5.4 percent.

###

California Auto Outlook Quarterly is produced for CNCDA by Auto Outlook, Inc., an independent research company specializing in the analysis of statewide and regional automotive markets. When reporting these auto industry trends please acknowledge the Data Source: Experian Automotive.

The report provides comprehensive information on CA’s new vehicle market, including annual trends, a two-year perspective, segment watch, the top five models in each segment, brand scoreboards, regional comparisons, and more. Access the complete report at: www.cncda.org.

About CNCDA

For 99 years, California New Car Dealers Association has represented the interests of California’s franchised new car and truck dealers. CNCDA members are primarily engaged in the retail sale and lease of new and used motor vehicles, and provide automotive products, parts, service, and repairs. In 2022, CA’s franchised new car dealers sold more than 1.6 million new cars and trucks, employed more than 136,000 people, paid $8.46 billion in sales tax, and donated $62.84 million to charitable and civic organizations. As the nation’s largest state association of franchised new car and truck dealers—with over 1,200 members—CNCDA provides legal compliance and legislative, regulatory, and legal advocacy.