California New Car Dealers Association Releases Q1 2025 Auto Outlook Report

Contact: Autumn Heacox, Director of Communications & Marketing: aheacox@cncda.org, (916) 441-2599 x105

Q1 2025 CA Auto Outlook Report: Tesla Tumbles with Sixth Straight Quarterly Decline; Slows CA’s ZEV Market

Overall Market (and Hybrids) Make Strides

SACRAMENTO, CA, April 16, 2025— Today, the California New Car Dealers Association (CNCDA) released its California Auto Outlook Report covering the first quarter of vehicle registrations in the state for 2025. The report summarizes California’s new vehicle registrations and predicts anticipated yearly sales. For accurate reporting, please cite Experian Automotive as the data source for CNCDA’s Auto Outlook.

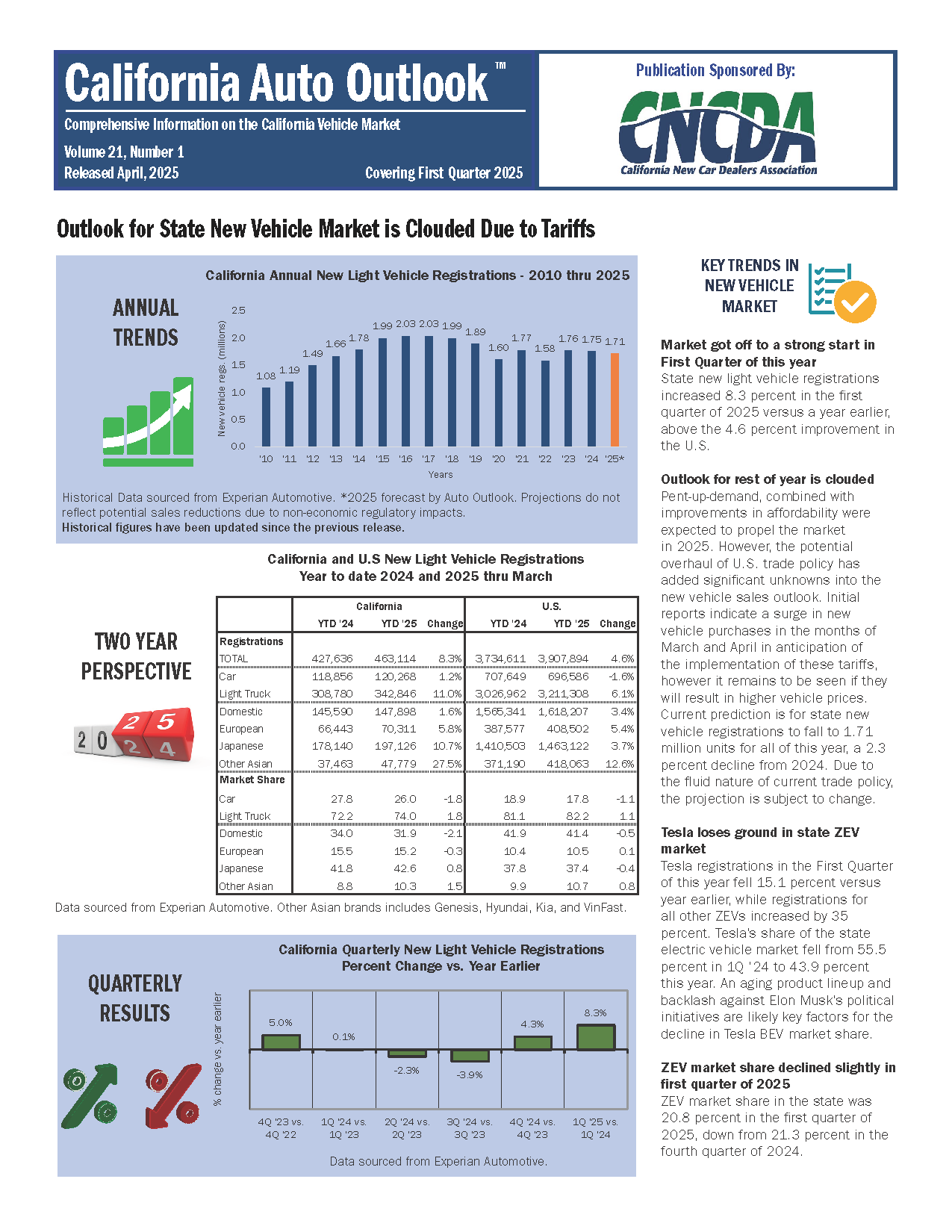

Statewide Impacts

Tesla’s troubles continue to worsen as Californians are giving the cold shoulder to the direct-to-consumer automaker (and controversial owner, Elon Musk). Registrations show a massive decline of 15.1 percent through March vs. this time last year. A year and a half of continuous quarterly declines proves this downward trajectory for Tesla is a lasting trend. The company’s market share also dropped by 11.6 percent at the end of Q1, now holding less than half of the California Zero Emission Vehicle (ZEV) market for the year.

Tesla’s shrinking sales are dragging down the state’s zero-emission vehicle sales momentum. California posted a second quarterly decline in ZEV registrations, holding just 20.8 percent of the market share (down from 22 percent in 2024).

The state’s ZEV market share would need to increase by 14.2 share points to meet the California Air Resources Board’s Advanced Clean Cars II mandated level of 35 percent for 2026 model year vehicles (representing a 68 percent increase in ZEV registrations). The state’s franchised new car and truck dealers begin selling 2026 model year vehicles in a matter of weeks.

“Dealers sell what customers want to buy. No mandate can force consumers to choose otherwise. Although the manufacturers we represent are increasing EV sales in California, with the substantial decline in Tesla sales, EV market penetration is largely flat. This puts us well short of EV sales mandates that take effect this year,” said Robb Hernandez, CNCDA’s Chairman and President of Camino Real Chevrolet.

Key Highlights

Still, the California sun is shining on the automotive market. Overall, new vehicle registrations among all brands showed a massive 8.3 percent growth from this time last year. A promising 463,114 vehicles were registered in the Golden State last quarter. Another bright light: California’s hybrid market is soaring. Hybrids now hold 17.9 percent of the market share, coming closer than ever to reaching the state’s ZEV numbers.

However, the forecast is cloudy with uncertain predictions for the remainder of 2025; registrations are now expected to dip 2.3 percent to 1.71 million for the full year. Looming trade policy changes have thrown a wrench into the outlook. A rush of buying in March and April, likely ahead of anticipated tariffs, may be short-lived if vehicle prices spike.

Brand Market Share and Summary

Among all powertrains and brands, Toyota tops California, with 76,625 registrations in Q1, holding 16.5 percent of California’s market share. Honda jumped up a spot this quarter to take 10.8 percent of the market share. And Tesla came in third, with 9.1 share of California’s market, losing 2.6 percent from this time last year.

Toyota also leads California’s light truck market with Ford and Honda in second and third.

Several brands racing ahead with registrations improving by 30 percent (or more) YTD include: Buick, Mitsubishi, Genesis, Chrysler, Cadillac, Land Rover, Nissan, and Hyundai.

Model Segment Rankings

California’s best sellers in the primary segments so far in 2025 are the Toyota Camry, Tesla Model 3, Honda Civic, Toyota Tacoma, Ford F-Series, Toyota RAV4, Honda Prologue (which also took third place in the alternative powertrain market), and the Lexus RX.

The top three passenger cars sold this quarter were the Tesla Model 3 (11.6 percent of share), the Toyota Camry (holding 11.5 percent) and the Honda Civic with 10.7 percent of California’s market share. The top three light trucks sold were the Tesla Model Y (6.8 percent share), the Toyota RAV4 (4.9 percent share), and the Honda CR-V (4 percent share).

Regional Variances

Northern California passenger car sales were up .8 percent, and light trucks were way up with an 8.4 percent increase in registrations. BEVs account for 24.6 percent of Northern California’s market share. In Southern California, passenger car registrations were down 3.1 percent, while light trucks grew 7.1 percent, with BEVs taking a 23 percent share of the market.

Click here to read the full Q1 2025 Auto Outlook Report

###

California Auto Outlook Quarterly is produced for CNCDA by Auto Outlook, Inc., an independent research company that analyzes statewide and regional automotive markets. When reporting these auto industry trends, please acknowledge the Data Source: Experian Automotive.

The report provides comprehensive information on California’s new vehicle market, including annual trends, a two-year perspective, vehicle powertrain dashboard, segment watch, the top five models in each segment, brand scoreboards, regional comparisons, and more. Visit www.cncda.org.

About CNCDA

For over 100 years, the California New Car Dealers Association has represented California’s franchised new car and truck dealers. CNCDA members are primarily engaged in the retail sale and lease of new and used motor vehicles and provide automotive products, parts, services, and repairs.

In 2024, California’s franchised new car dealers sold more than 1.85 million new and used cars and trucks, employed more than 138,478 people, paid $8.83 billion in sales tax, and donated $70.75 million to charitable and civic organizations. CNCDA is the Nation’s largest state association of franchised automotive dealers, with nearly 1,200 members, and provides legal compliance and legislative, regulatory, and legal advocacy.