California New Car Dealers Association Releases First Quarter 2023 Auto Outlook

Contact: Autumn Heacox, Communications & Marketing Director: aheacox@cncda.org, (916) 441-2599 x105

CA 1Q 2023 Auto Market Recap: New Sales Show Positive Numbers;

EV, Overall 2023 Registrations Expected to Grow

May 15, 2023, SACRAMENTO – The California New Car Dealers Association released its first quarter 2023 California Auto Outlook report today, showing significant improvement in new vehicle registrations compared to 1Q 2022 numbers.

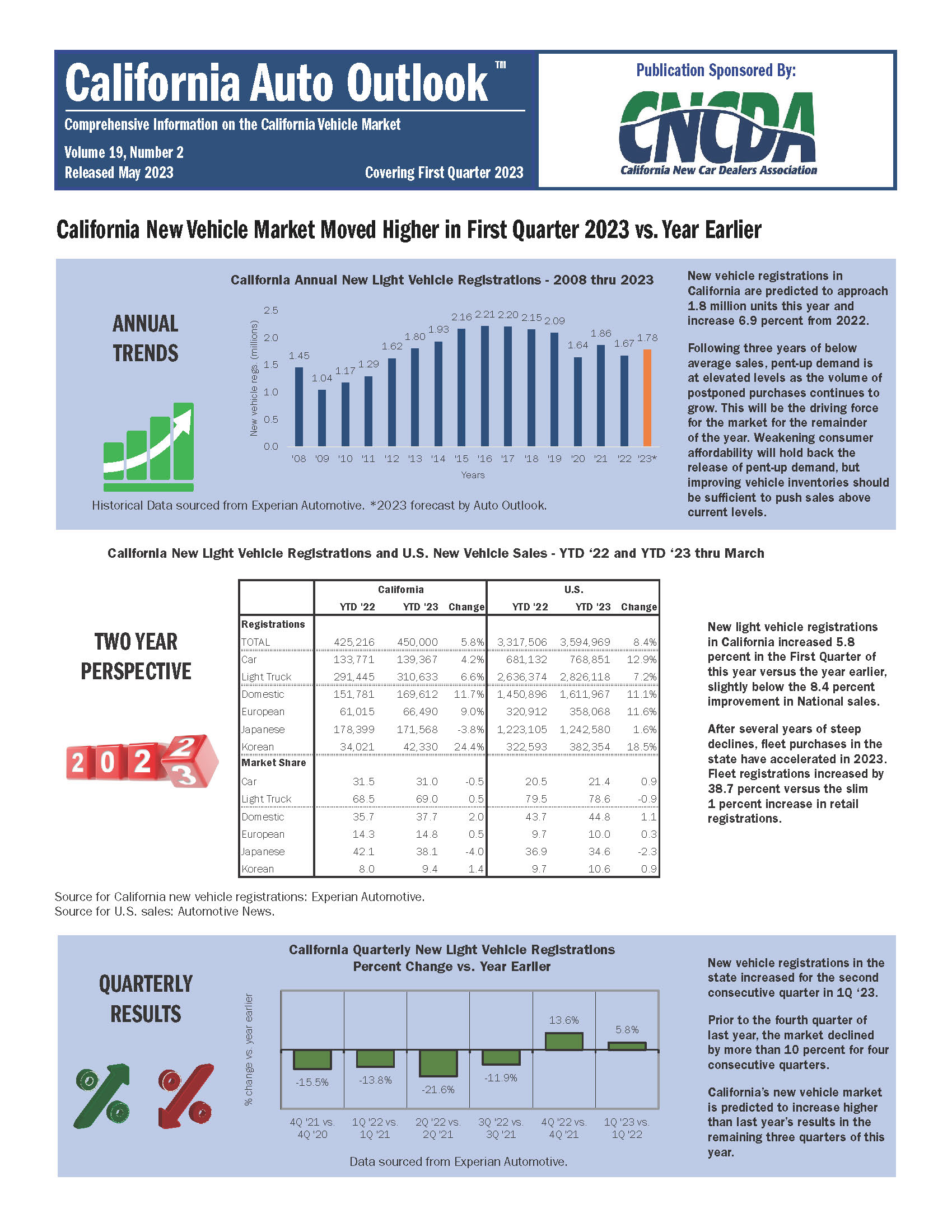

Overall, 2023 projections indicate that registrations are expected to increase roughly 6.9 percent more than last year (just shy of 2021 sales numbers), despite increasing economic uncertainty in the state and nationwide. CNCDA’s quarterly Auto Outlook data is sourced from Experian Automotive.

Report highlights reflect that pent-up demand (due to supply chain and inventory shortages) kept new car sales somewhat insulated from economic dips felt in other sectors. As noted in our previous report, 4Q 2022 was a bright spot last year, and 1Q 2023 is proving to continue this upward sales trend, with a 5.8 percent increase (450,000 registrations) YTD versus 1Q 2022, at 425,216 registrations posted. Much of this increase is directly attributed to the recent large volume of fleet sales in California.

Additionally, as franchised dealers roll out new electric vehicle models from their respective original equipment manufacturers (OEMs), Californians’ appetite for Zero Emission Vehicles (ZEVs) continues to grow. The new electric and hybrid/ electric vehicle market share sales grew staggeringly last quarter, posting the highest percentages California has ever seen at 34.2 percent of the market share in 1Q 2023 (up from 31.1 percent in all of 2022).

The recent increase in ZEV market share is likely due to more 2023 ZEV models available and Californians’ willingness to shift to and adopt electric and hybrid vehicles. Unsurprisingly, CA again places first for ZEV sales at 24.2 percent, while the next closest state is OR, coming in at roughly 17 percent for ZEV retail vehicle registrations last quarter.

However, as franchised dealers continue to offer more electric and hybrid options to CA’s motoring public, their market share is steadily rising. Last quarter franchised new car dealers showed a noteworthy 140 percent increase in ZEV sales YTD, while direct-to-consumer EV sellers (such as Tesla) were up only 15 percent YTD in CA.

“It’s an exciting time for franchised new car dealers in California. We are getting new inventory, and the latest ZEV models are rolling out from the mainstay manufacturers. It’s exciting to offer the types of cars our customers have been asking for,” said CNCDA Chairman Tony Toohey, owner of Auburn Toyota. “Each new car dealership in California has roughly 95 employees, so when a consumer buys from a dealer, they directly support the livelihoods of hard-working people and their families. This is why we value our returning customers tremendously.”

Brand Market Share

Toyota held the top of California’s market share last quarter at 15.3 percent amongst all vehicle brands, followed by Tesla at 11.8 percent, Ford at 8.9 percent, Honda at 8.7 percent, and Chevrolet at 7.7 percent.

Interestingly, Chevrolet had an outstanding first quarter of 2023, with a 47.1 percent increase in registrations. Followed by Genesis at 41.8 percent, Buick at 39.7 percent increase, Audi with a 38 percent increase, and the fifth-place spot was taken by Porsche, posting a 31.6 percent increase.

On the other hand, Californian’s love affair with Tesla may have already reached a plateau. The report reveals that the company posted only a 10.6 percent increase for 1Q 2023 compared to registrations for the same time last year. With more OEMs offering newer ZEVs this year and next, Tesla registrations in CA may continue to stall or even decline.

Fleet and Retail Market Share

Notably, the increase in California’s YTD registrations was primarily due to fleet car sales which were up 47.0 percent. Fleet light trucks were up 35.3 percent, and retail light trucks were up 2.2 percent. The only decline was in retail car sales, down by 1.7 percent compared to 2022 YTD.

Regional Variances

SF Bay Area’s new vehicle market showed very promising signs of growth. For the first time in a year, the region showed positive sales, reporting an impressive 9.8 percent increase from this time last year. The Southern California overall market is nearly identical to last year’s sales, posting a .1 percent increase. Northern California registrations only rose 2.6 percent YTD.

The complete report can be accessed on CNCDA’s website.

###

California Auto Outlook Quarterly is produced for CNCDA by Auto Outlook, Inc., an independent research company specializing in the analysis of statewide and regional automotive markets. When reporting these auto industry trends please acknowledge the Data Source: Experian Automotive.

The report provides comprehensive information on the state’s new vehicle market and includes annual trends, a two-year perspective, segment watch, the top five models in each segment, brand scoreboards, regional comparisons, and more. Access the complete report at: www.cncda.org.

About CNCDA

For 99 years, California New Car Dealers Association has represented the interests of California’s franchised new car and truck dealers. CNCDA members are primarily engaged in the retail sale and lease of new and used motor vehicles, but also provide customers with automotive products, parts, service, and repairs. CA’s franchised new car dealers sold more than 1.6 million new cars and trucks in 2022 and employed more than 136,000 Californians.

In 2022, new car dealers significantly contributed to CA’s economy, paying $8.46 billion in sales tax and giving $62.84 million in donations to charitable and civic organizations. As the nation’s largest state association of franchised new car and truck dealers—with nearly 1,200 members—CNCDA provides legal compliance and legislative, regulatory, and legal advocacy.